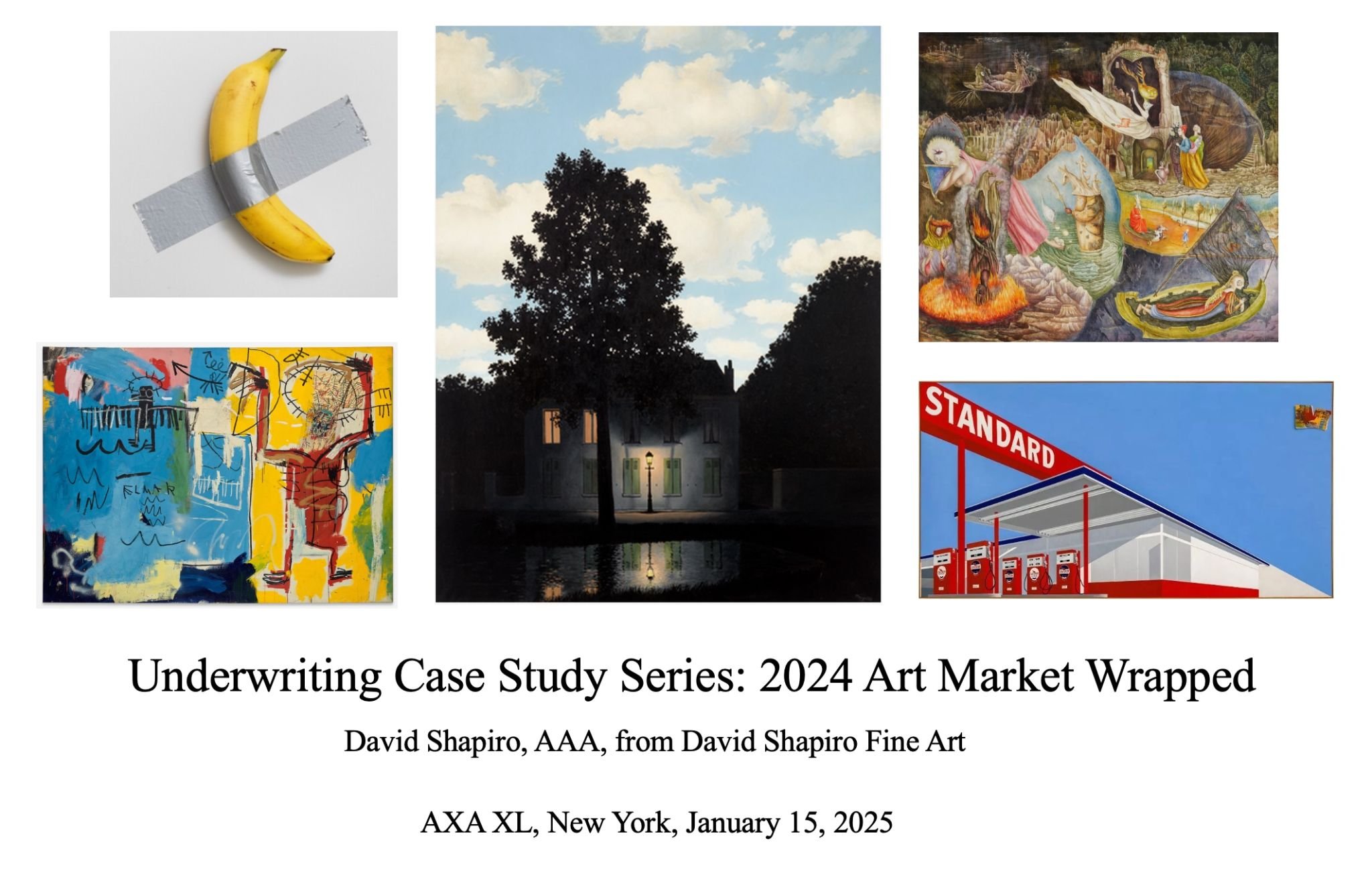

This week I had the pleasure and honor to present a 2024 art market recap to underwriters at AXA XL Insurance.

Finishing 2024, statistics of decline could be seen everywhere, particularly when comparing overall year-to-year sales totals (i.e., 2024 with 2023 and especially 2022), and yet the overall picture is a more nuanced one. Broadly speaking, my presentation complicated the overarching correction narratives that have prevailed in the press.

Fluctuations in supply, particularly at the highest end, often depend on circumstantial factors such as the availability of major estates. As such, any comparison to 2022 will be skewed by the Paul Allen auction (especially) and the Ammann sale.

The failure of any lot to sell at auction for over $50 million in the first half of 2024 did look paltry given the offerings in the immediate past, but in the second half of the year, the three highest lots at auction totaled $255.4 million, over double the total of the three highest lots sold in the first half of the year.

The price realized for the Magritte alone ($121.6 million) was similar to the total of the prices realized for the three highest lots sold during the first half of the year, and the fact that it sold for over $25 million more than a confident estimate (with guarantee) suggests that present demand is strong in the market for highest-end masterpieces, when in fact there is supply.

As such, when Zachary Small asked in a doom-and-gloom article on November 2, 2023, whether the art market “will need to discount its masterpieces,” the answer seems to be a resounding, “NO” – at least not at the high end of the markets.

In 2024, collectors chased high-end non-art masterpieces as well, such as the stegosaurus skeleton, Dorothy’s ruby slippers, and Babe Ruth’s “called shot” jersey, which respectively shattered auction records for fossils, movie memorabilia, and sports memorabilia, collectively underscoring the expansive cross-sector outlook of the trophy market at present.

Other markets, however, were indeed cooler. The middle market remained artist-specific, with a continued trend toward selectivity for some artists. And in 2024, the market for many emerging artists fully collapsed, following a moment of rapid speculation-oriented growth in the covid period.

Also addressed in my 2024 market recap were notable developments such as:

The reuturn of the acceptance of cryptocurrency as payment for auction lots, by Sotheby’s for Cattelan’s Comedian.

The seismic security breach that took place in May when Christie’s website was hacked, making it inoperable during the marquee sale week.

Sotheby’s overhaul and subsequent reversal (less than a year later) of their fee structure, both for buyers and for sellers. The implications of this are also covered in my recent contribution for Artnews.